So, this monsoon, it's raining IPOs! In August, we welcomed eight new IPOs and witnessed the whopping listing of another two. And one thing investors can’t stop talking about is GMP! Let's deep dive into what GMP is in time lesser than what your instant noodles would otherwise take.

A quick brief on IPO:

For the uninitiated, IPO stands for Initial Public Offering. When a privately held company offers its shares to the investors in the market (called primary market) for the very first time, it is said to have offered an IPO. It means that hereafter the company’s shares would be tradable in the secondary market (stock market).

Now, spare a few seconds to understand IPO Issue Price and IPO Listing Price.

IPO Issue Price is the one at which the company’s shares are offered to the investors. It can be either a Fixed Issue Price or Book-Building issue price (a price range).

IPO Listing Price is the one at which the shares open on the listing day taking the demand-supply factors and the general market sentiments into consideration. An investor buys the shares at the issue price with the hope of making a profit by a higher listing price. When the issue price is greater than the listing price, IPO is called to be listed at a DISCOUNT. And when the former is lesser than the latter, it is called to be listed at PREMIUM. And this is where the concept of GMP comes into play!

A peep into GMP:

GMP stands for Grey Market Premium. It is an estimated price on which the shares are likely to be listed on the stock exchanges (NSE & BSE). It reflects an EXTRA price that a buyer is willing to pay to grab a share in the grey market, owing to its high demand and its future potential.

In simpler terms, it is the price at which traders bid and offer for the hitherto unlisted securities (in the form of IPO applications), in the period between the IPO issue date to the allotment date. All this happens but in GREY MARKET!

It is ‘Grey Market’ because it is unofficial, though not illegal, and not regulated by SEBI. Here, trades happen within a tight-knit trustworthy group. But mind it, this is not for us! Market participants indulge in grey market trades to either pile up or clear the shelves if they feel that the shares would be risky and wouldn’t keep by their expectations on the listing date.

This entire phenomenon affects their overall demand-supply dynamics in the following way:

The higher the demand for shares, the higher the additional price investors are willing to pay i.e. Higher GMP.

Higher GMP indicates a High Listing price and that’s why most retail investors take GMP as the only factor in deciding whether to apply or not in an IPO.

Going over your head?

Say Zomato! Zomato came up with an IPO Issue price of Rs. 72-76 (Yes, this is Book-Building Issue Price). Its GMP before listing hovered around Rs 27, which indicated that the buyers were ready to pay an EXTRA Rs.27 over the issue price of the share i.e. at 76+27= Rs. 103. Showing strong demand, the shares of ZOMATO IPO got listed at Rs. 116/ share.

It may be clear now that GMP hints at the listing price of the share. And no doubt that an investor would be interested in applying only to those IPOs where GMPs are going high.

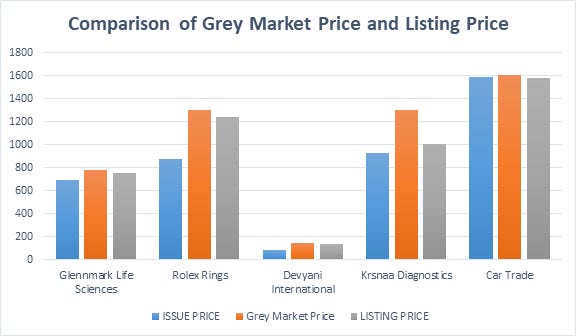

But does higher GMP guarantee higher Listing-Day Gains?

Well, No. GMP is not a guarantee but an indicator with fair chances of heads and tails. GMP alone is not enough for deciding whether or not to invest in an IPO. It is the fundamentals of the company which matters in the long term! Because after all, it’s just a game of guesstimate!

As stock markets believe in Murphy’s Law, “If anything CAN go wrong, it WILL go wrong.”

Till then, happy investing!